In the second version of Galileo FX, we are excited to announce that our focus will be on three critical pillars to increase profitability and minimize losses:

1. Improve the Accuracy of Consecutive Signals: We're optimizing our algorithms to increase the precision of the bullish and bearish signals our bot generates. This means fewer false positives and negatives and more successful trades.

2. Enhance Risk Management: Our upgraded version will feature an enhanced risk management system.

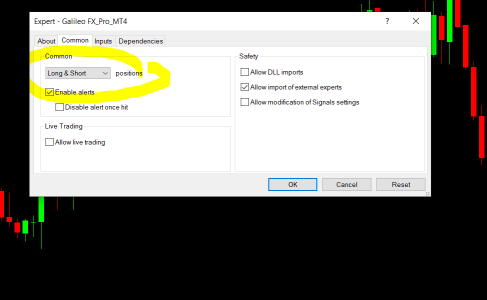

3. Increase User Customization: Our third pillar for improvement will be around user customization. We believe in empowering our users with more control over their trading strategies. So, we're working to add more options for custom settings, including the option to decide if the robot should buy or sell after X consecutive signals.

As we continue to improve Galileo FX, your feedback and ideas are invaluable.

If there's a feature you'd love to see, or if you have thoughts on how we can make Galileo FX even better, we'd love to hear from you.

Please feel free to share your suggestions and ideas with us, and help us shape the future of Galileo FX.

1. Improve the Accuracy of Consecutive Signals: We're optimizing our algorithms to increase the precision of the bullish and bearish signals our bot generates. This means fewer false positives and negatives and more successful trades.

2. Enhance Risk Management: Our upgraded version will feature an enhanced risk management system.

3. Increase User Customization: Our third pillar for improvement will be around user customization. We believe in empowering our users with more control over their trading strategies. So, we're working to add more options for custom settings, including the option to decide if the robot should buy or sell after X consecutive signals.

As we continue to improve Galileo FX, your feedback and ideas are invaluable.

If there's a feature you'd love to see, or if you have thoughts on how we can make Galileo FX even better, we'd love to hear from you.

Please feel free to share your suggestions and ideas with us, and help us shape the future of Galileo FX.